From Family Ties to Home Buys: The Nepotism Factor in Real Estate

Key Takeaways

-

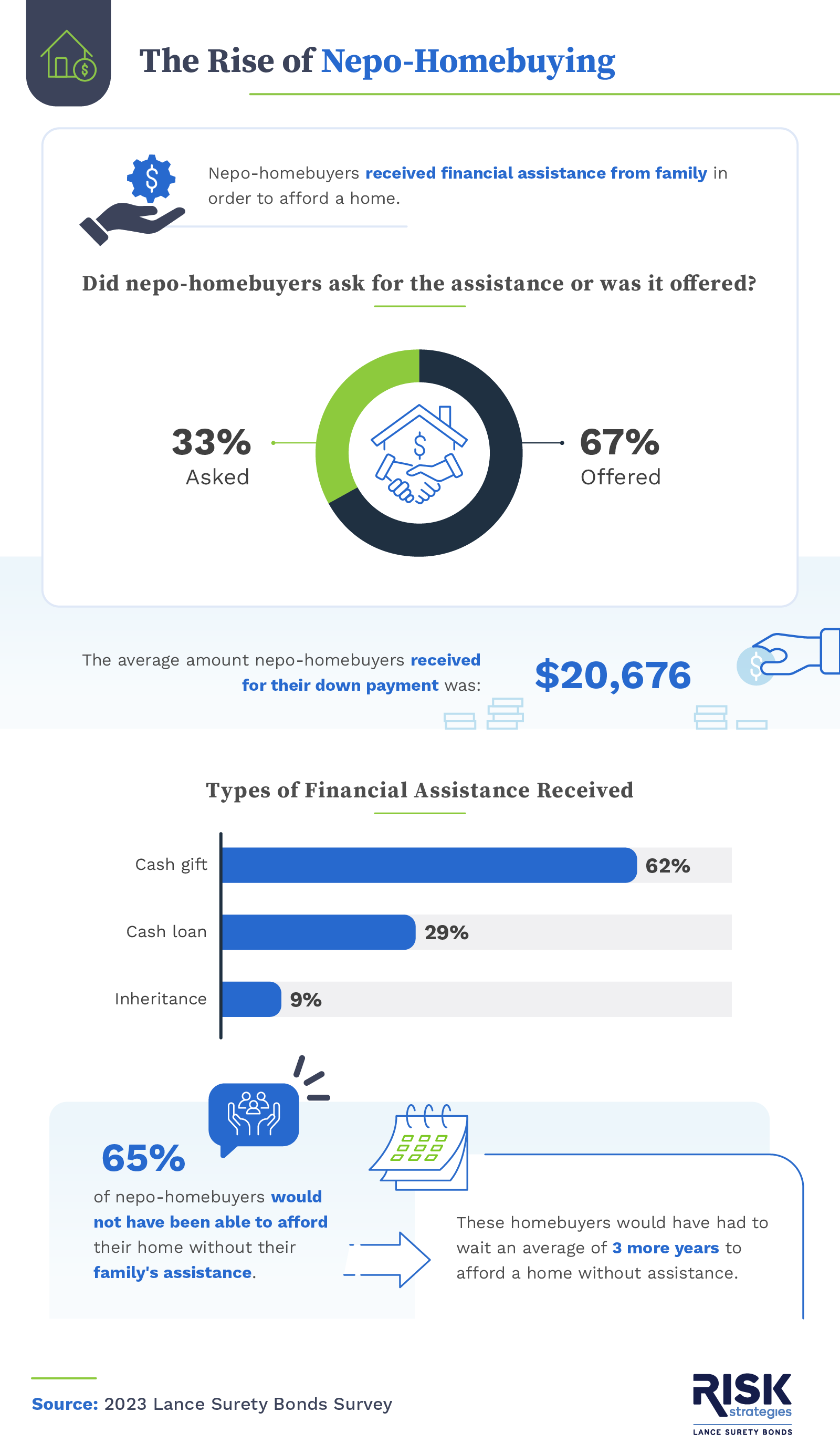

Nepo-homeowners received an average of $20,676 from their family to help with a down payment on a home.

-

67% of nepo-homeowners received financial assistance without even asking.

-

62% of nepo-homeowners received a cash gift with no expectation of repayment.

-

65% of nepo-homeowners couldn't have bought a home without family assistance.

-

65% of renters believe nepo-homebuying is contributing to the current housing market conditions.

Family Lending is Trending

There's a new kid on the block in real estate these days, the nepo-homebuyer. These first-time homeowners earned their nickname because they used family money to help buy a home. Some are grateful for the trend, while others believe it contributes to wealth inequality. To learn more about the situation, we surveyed 396 homeowners, 66% of whom were nepo-homebuyers, and 302 renters. Let's explore how family lending is impacting the homebuying scene.

Key Takeaways

- 65% of nepo-homebuyers would not have been able to afford their home without their family's help. Without assistance, they would have had to wait an average of 3 more years to buy a home.

- The average nepo-homeowner received $20,676 from family for their down payment.

- 73% of nepo-homebuyers were given assistance from their parents, 11% from their grandparents, and 15% from someone else in their family.

- 67% of nepo-homeowners revealed they were offered support without even asking.

- 62% of nepo-homeowners said the assistance they received was a cash gift with no expectation of repayment; they received $19,660, on average.

- Those who were loaned money by a family member received an average of $20,902.

- One-third of nepo-homebuyers feel guilty for being indebted to the family member who helped them purchase their home.

- Luckily, only 7% on nepo-homebuyers said their relationship with their family member suffered from receiving financial assistance from them.

- 17% of nepo-homebuyers have rented or plan to rent out the home that they purchased with their families' assistance.

- 12% of nepo-homebuyers went over budget on their home.

Key Takeaways

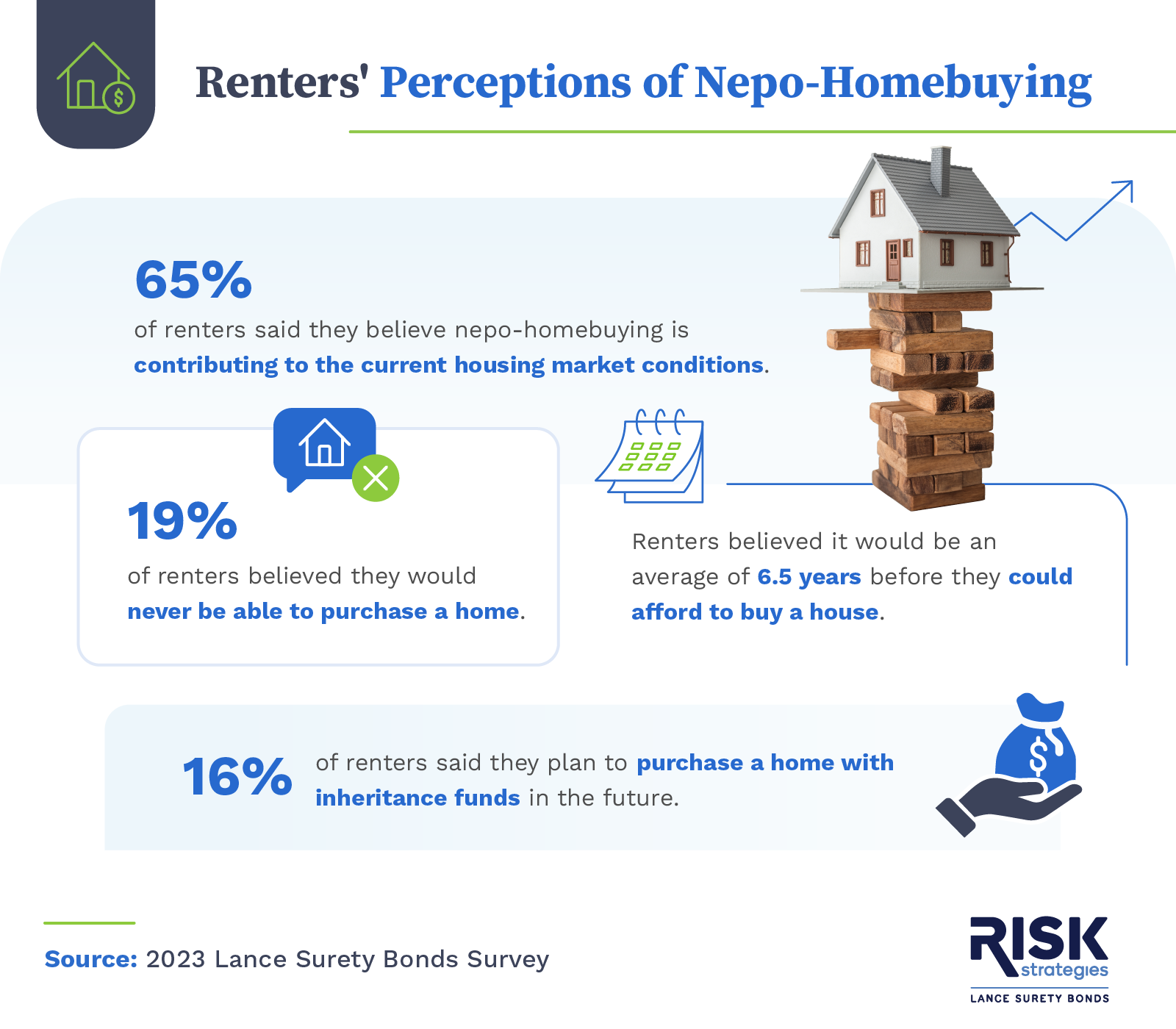

- 72% of renters believe the trend of nepo-homebuying perpetuates wealth inequality.

- 65% of renters believe that nepo-homebuying is contributing to the current housing market conditions.

- Nearly 1 in 5 renter believe they'll never be able to purchase a home.

- Renters believe it will take an average of 6.5 years before they can afford a home.

- 16% of renters plan to purchase a home with inheritance in the future.

Unlocking the Doors of Opportunity

Many Americans dream of owning a home, but it's now more expensive than ever. While financial assistance from family members helps some first-time homebuyers, it raised concerns about housing and wealth inequality for others. It's important for policymakers and those in the real estate industry to address these issues and find solutions together, making homeownership more accessible and improving Americans' quality of life for generations to come.

Methodology

Lance Surety Bonds surveyed 396 homeowners, 66% of whom were nepo-homebuyers, and 302 renters to gather their views on nepotism in real estate. Please note: some percentages don't total exactly 100 due to rounding.

About Lance Surety Bonds

Lance Surety Bonds is a trusted and experienced provider of surety bonds, including mortgage broker bonds. We're dedicated to helping people meet their bonding needs, especially those in the real estate industry.

Fair Use Statement

Know someone in real estate who would benefit from our survey insights? You're welcome to share these findings for noncommercial purposed as long as you include a link to this page as the source.

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.