What Is the Difference between a Surety Bond and Insurance?

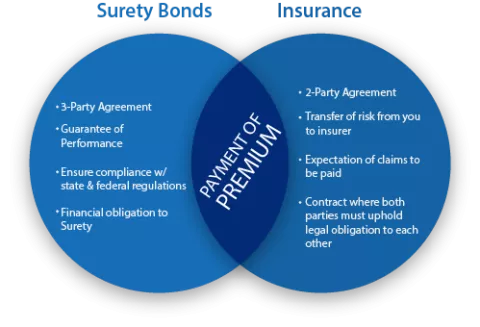

Surety bonds and insurance are two forms of security that serve different purposes.

Surety bonds guarantee the legal compliance of businesses and individuals. They may be required of you you or your company to guarantee you will fulfill your contractual obligations, or will follow certain rules, laws or regulations.

You can think of surety bonds as an extra line of credit extended to you as the bonded party. Bonds protect the interests of your clients, of public authorities, or of another entity -- and not yours.

Insurance, on the other hand, protects the insured entity. The insurance company offers compensation in case any incidents and losses covered by the policy occur. The insurer mitigates the risks you are facing in return for regular premium payments.

How Do Surety Bonds vs Insurance Work?

In bonding, there are three parties. The principal is the party that has to get bonded -- you or your company. The obligee is the entity that requires the bond, which is usually a state or local authority. The bond is underwritten by a surety that ensures you will fulfil, the conditions set by the obligee.

In insurance, there are only two parties -- you as the insured entity, and the insurance company.

Who Needs to Get a Surety Bond or Insurance?

Both surety bonds and insurance are required from a wide range of businesses to mitigate risks in different aspects of their operation. They are both risk-management tools, but are used for different purposes. In many cases, businesses are actually required to obtain both a surety bond and a relevant type of insurance.

The most common professions that need to get bonded include auto dealers, construction contractors, freight brokers, telemarketers, and mortgage brokers, among others. Usually the surety bond -- known as a license bond -- is an essential requirement during their licensing process.

Contract bonds are another type of commonly required bonds. They guarantee the completion and quality of construction projects. Contract bonds are obtained on a project basis.

As for insurance, its application is widespread. Even when not required by a third party, both individuals and companies may choose to get insurance to mitigate certain risks.

The Premiums for Surety Bonds vs Insurance Policy

There is a difference between insurance and bonds in terms of how their premiums work too.

To get bonded, you’ll need to pay a premium which is a small percentage of the bond amount you are required to post. The bond premium covers the underwriting and pre-qualification services costs.

Your surety bond cost depends on the strength of your personal finances and in some cases, on your business finances too. The most important factor is your credit score. Other factors that may play a role include company finances and any fixed and liquid assets you may have.

To obtain an insurance policy, you’ll also need to pay a premium. However, it works in a different way than with bonds. The insurance premium is your regular payment to the insurance company in return for transferring certain risks to it. Your insurance provider determines your premium based on the risk involved and the type of insurance you need.

The Claims Process for Surety Bonds vs Insurance

If you fail to fulfill your obligations under a surety bond, you may get a claim against it. This is how a harmed party can seek fair reimbursement for financial losses caused by illegal actions on your side.

If the claim is proven, you’ll need to compensate the claimant with a sum which can be as high as the bond amount. Even if the surety makes the claim payment at first, the entire risk stays with you as the principal. You’ll need to reimburse the surety soon after.

The claims process works in a different way for insurance policies. Typically, in case of an occurrence covered under the policy, you can claim reimbursement for your losses from the insurance company. The financial risk remains with the insurance provider.

How to Get a Surety Bond?

You can start your bonding process by applying online for a free quote.

Once you get approved, you can purchase your bond online.

About Us