Surety Bond Rates

COST SAVING TIPS: LICENSE BONDS

Bond companies are not all created equal. Some of the larger sureties will only consider writing bonds for top tier applicants, with stellar credit. However, there are some sureties willing to aggressively write bonds for customers with less than perfect credit, and little to no experience.

NEW: Download our FREE ebook guide to learn all about reducing your bond rate, regardless of which type of bond you're applying for!

Lance Surety prides itself on being able to bond all types of customers. We represent a variety of markets, and offer exclusive bonding programs designed to save you money. Before you take the time to apply with countless bondbrokers, find the right bond agency for you!

HOW TO STRENGTHEN YOUR APPLICATION

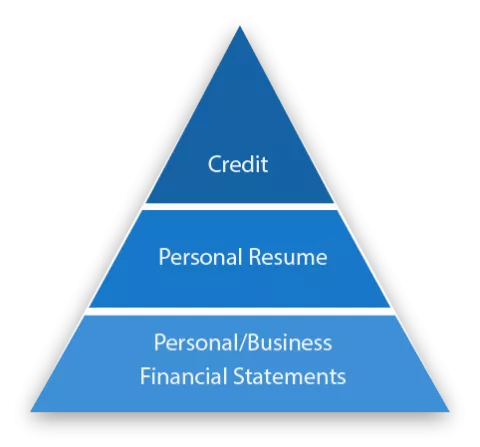

One of the biggest differences between surety bonds and insurance is that fact that surety bond companies typically do not want to bond someone likely to be unable to pay off a claim. This is why personal credit history is looked at so closely. If you have a history of falling behind on payments, or have tax liens, etc., there are steps you can take to strengthen your bond application in hopes of finding the lowest possible rate.

1. Clean up your Personal Credit

There are countless credit repair organizations throughout the nation that specialize in helping you clean up your credit profile. The three major credit reporting agencies that sureties typically look when underwriting a policy are TransUnion, Experian and Equifax. The three different agencies are not always on the same page. If you have paid off previous unpaid collections, it may show up on TransUnion, but may still be showing as unpaid on another report. If you have a history of delinquent items on your credit reports, working with a credit repair company may be something worth considering.

2. Demonstrate your Experience

While many license bonds can be underwritten based solely on owner personal credit, that clearly does not paint the entire picture of you as an applicant. If you have relevant industry experience, you may want to consider providing a professional resume demonstrating that you have the knowledge and experience necessary to succeed. Having applicable experience can improve your chances of being offered a lower rate for your bond

3. Show your Financial Strength

In addition to showing off your industry experience, you can further strengthen your application by demonstrating a strong net worth. You want to be able to demonstrate to the surety underwriter that you have the capital to successfully operate your business in good times and in bad. The following are items to consider providing during the application process:

- Cash-on-Hand

- Investments

- Personal Assets (i.e. Real Estate)

- Personal Financials

- Business Financial Statements

Try Our Surety Bond Cost Calculator

Simply enter your bond type, bond amount and credit score below and you'll receive an instant ballpark estimate on your premium!

Surety bond cost calculator

About Us