How to Get a California Money Transmitter License [2021 Guide]

Do you want to launch a business as a money transmitter in California? Then you’ll need to get a California money transmitter license.

The California Money Transmission Act defines money transmission as selling or issuing payment instruments or stored value, or receiving money for transmission.

The licensing requirements are set by the California Department of Financial Protection and Innovation (DFPO). The application process is handled by the Nationwide Multistate Licensing System and Registry (NMLS).

Read on for the full details on how to get your California money transmitter license.

1. The California Money Transmitter License Requirements

You’ll have to fulfill all the criteria set by the state Division of Financial Institutions at the Department of Financial Protection and Innovation.

The complete list of requirements is available in the NMLS Checklist.

Business Documents

Your first step is to register a business entity with the California Secretary of State. You’ll also need to register a trade name if you wish to use a DBA.

With your application form, you’ll have to submit the following documents too:

- Primary contact employees information

- FinCEN Registration Confirmation Number (if applicable)

- Certificate of Authority/Good Standing Certificate

- Bank account information for your primary Letter/Line of Credit, Operating, and/or Trust Primary accounts used for conducting money transmission business in California

- Control Person (MU2) Attestation

- A copy of a resolution of the board of directors (Board Authorizations)

- Business plan

- Anti-Money Laundering (AML) / Bank Secrecy Act (BSA) Policy

- Flow of Funds Structure

- Office of Foreign Assets Control (OFAC) Compliance Information

- Management Chart

- Organizational Chart

- Document samples - your receipt for transactions that involve money received for transmission and your payment instrument or instrument upon which stored value is recorded (if applicable)

- At least 2 banking references

- Policies and procedures for selection and supervision of agents

Credit Reports and Financial Statements

All individuals in a position of control on your application should authorize a credit report check.

You’ll also have to provide the following financial statements, certified as correct by the chief financial officer:

- Pro forma financial statements

- Audited financial statements for the two-year period previous to the most recent audited financial statement uploaded in the NMLS

- Unconsolidated financial statements for the current fiscal year

- Most recent report filed with the United States Securities and Exchange Commission for publicly traded companies

- Audited financial statements for the parent corporation for the most recent fiscal year or a copy of the parent corporation’s most recent report filed under Section 13 of the federal Securities Exchange Act of 1934 (for wholly-owned subsidiaries)

- A current (within 60 days) balance sheet income statement

- Statement of income and of changes in shareholders' equity for the last 3 fiscal years

Your financial statements should demonstrate you meet the requirement for a minimum tangible net worth of $500,000.

Each director, executive officer, or 10% equity security owner has to supply a Confidential Resume and a current Personal Financial Statement too.

Criminal Background Check

All executive officers, directors, and owners or controllers of 10% or more of voting shares have to authorize a fingerprint check with the California Department of Justice.

2. Complete the California Money Transmitter License Application

Before you apply for your California money transmitter license, you’re advised to arrange a pre-filing meeting with the staff at the Division of Financial Institutions. You can contact:

- Oscar Lumen at (415) 263-8577 or by email at [email protected]

- Jonathan Lee at (213) 435-3921 or by email at [email protected]

The pre-filing meeting will help you clarify any questions about the license and the application process you may have.

Once you’ve compiled all required documents, it’s time to file your application with the DFPO.

California License Application Forms

You can apply online via the Nationwide Multistate Licensing System and Registry (NMLS). You’ll need to fill out Company Form (MU1) and submit it as the application form.

In addition to this, you’ll also have to submit the following:

- Signed and acknowledged Form 5025

- DFPI Form 2 for each control person

Licensing and Registration Fees

The application fee for a California money transmitter license is $5,000.

You’ll also need to cover a $15 credit report fee for each control person.

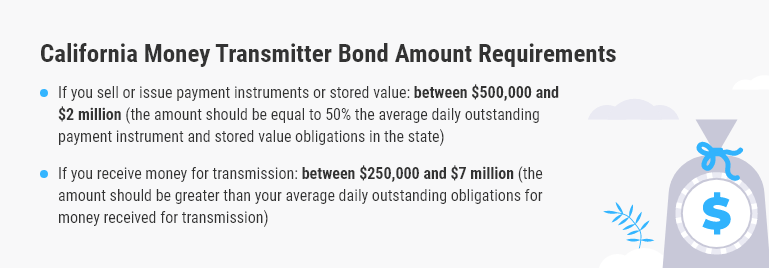

3. Provide a Surety Bond

Applicants for a California money transmitter license need to post a surety bond. It guarantees you will follow all applicable California money transmitter laws.

The bond amount requirements are the following:

- If you sell or issue payment instruments or stored value: between $500,000 and $2 million (the amount should be equal to 50% of the average daily outstanding payment instrument and stored value obligations in the state)

- If you receive money for transmission: between $250,000 and $7 million (the amount should be greater than your average daily outstanding obligations for money received for transmission)

The amount of your bond is not the same as the price you’ll need to pay, though. Your surety bond cost is determined by your surety when you apply.

The surety will use your personal credit score as the main point of reference to determining your bond cost. It may also review business and personal financial statements and other relevant financial information.

If you have a high credit score, of 700 FICO or more, you can expect to get bonded at the lowest possible rates - in the range of 1% to 5% of the bond amount.

You can obtain your California money transmitter bond straight away by applying online.

4. Submit and Receive Your California Money Transmitter License

You’ll need to submit all documents online via the NMLS. If your application is complete, you will be notified once you are approved as a California money transmitter.

Once your license application is approved, you’ll need to upload a list of your Authorized Agents who will conduct money services businesses in the state on your behalf. You’ll have to use the NMLS Uniform Authorized Agent Reporting (UAAR) functionality to do so.

You can check the status of your license through the Department’s Directory of Money Transmitters search.

5. Conclusion

The process of obtaining your California money transmitter license is rigorous and can take from a couple of months up to a year from start to finish.

Your license is active for one year. If you wish to extend it, you’ll need to apply for renewal before its expiration date.

Do you have further questions about the licensing and bonding process for money transmitters in California? Please share them in the comments section below!

If you’re ready to get your California money transmitter bond, just apply online today for a free bond quote.

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

Recommended Articles

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.