How Much Does a Florida Liquor License Cost? [2021 Guide]

If you wish to sell alcoholic beverages in Florida, you’ll have to comply with the licensing requirements in the state. But figuring out the Florida liquor license cost can be confusing.

How much is a liquor license in Florida, really? There are many different types of licenses depending on the type of liquor, the country you’re located in, and the place you’ll be selling. The fees you need to pay are thus different.

We've compiled this guide to help you out in your licensing process. Let’s go through the different types of Florida alcohol licenses, so you get a clear idea what the costs of each of them are.

The Liquor License Types and Their Costs

The state Department of Business and Professional Regulation issues three main Florida liquor licenses types. They are beer and wine licenses, beer, wine and liquor licenses, and club and special licenses.

Beer and Wine Licenses

You can get a number of different licenses for selling beer and/or wine. The annual license fees vary greatly between them, especially depending on the size of your county.

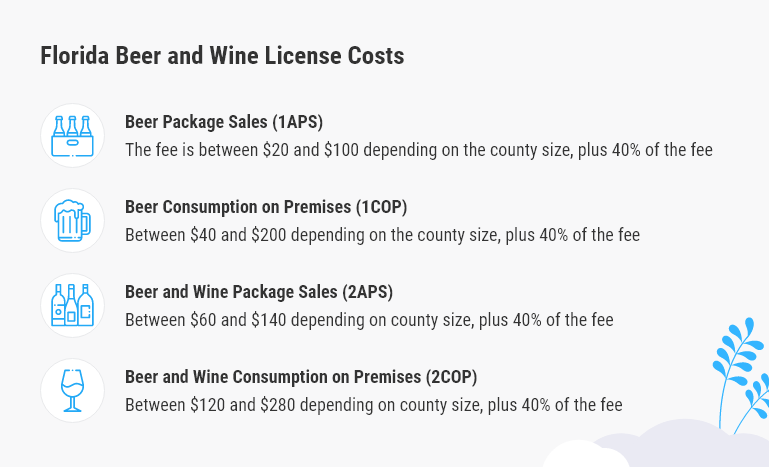

So, how much is a beer and wine license in Florida? Here are the costs:

- Beer Package Sales (1APS): The fee is between $20 and $100 depending on the county size, plus 40% of the fee

- Beer Consumption on Premises (1COP): Between $40 and $200 depending on the county size, plus 40% of the fee

- Beer and Wine Package Sales (2APS): Between $60 and $140 depending on county size, plus 40% of the fee

- Beer and Wine Consumption on Premises (2COP): Between $120 and $280 depending on county size, plus 40% of the fee

Beer, Wine and Liquor Licenses

Another set of Florida liquor licenses allow you to sell beer, wine and liquor. Their costs vary based on what the package includes and the size of your county.

Beer, Wine and Liquor Package Sales (for counties of different sizes):

-

- 3PS: $1,365

- 3APS: $1,170

- 3BPS: $975

- 3CPS: $643.50

- 3DPS: $468

Beer, Wine and Liquor Consumption on Premises (for counties of different sizes):

-

- 4COP: $1,820

- 5COP: $1,560

- 6COP: $1,300

- 7COP: $858

-

8COP: $624

You can check out the Fee Chart with full information about the beer and wine and the beer, wine and liquor license fees according to county size.

Club and Special Licenses

Besides the regular licenses for beer and wine or for all kinds of liquor, there are also club and special licenses for beer, wine and liquor consumption:

- Lodges/Club (11C): $400

- Special Club (11CS): $1,750

- American Legion Club (11AL): $500

- Performing Arts (11PA): $400

- Private Golf Clubs (11CG): $400

- Caterer (13CT): $1,820

- Race Track Caterer at Jai Alai, Dog and Horse Tracks (12RT): $675

The Florida Liquor License Process

Florida has a quota for liquor vendors based on the number of residents in a county. When the residents of a country increase by 7,500, a new quota license is created.

The Department of Business and Professional Regulation organizes a yearly lottery and grants liquor licenses to the winning participants. This is a great opportunity for your business to get a full license instead of struggling to transfer one from another business.

You’ll need to meet the Florida liquor license requirements. One of them is to obtain an alcohol bond. This is a kind of surety bond that guarantees your compliance with state legislation in terms of selling liquor.

Need a quote on your Florida liquor license bond? Fill in the short form below to get a quote!

The lottery runs from the third Monday in August for 45 days in every year in which at least one quota for an alcoholic beverage license is available. There is a non-refundable participation fee of $100.

Keep in mind that the fee for transferring a license is 10% of the annual fee without the 40% surtax. There are two possible license periods in the year: from October 1st to September 30th and from April 1st to March 31th.

Need more information about the Florida quota liquor license and bonding process? You can reach us at tel:877.514.5146.

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

Recommended Articles

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.