How much does a $75,000 surety bond cost?

A surety bond is a legal agreement made between three parties. These parties are known as the principal, the surety, and the obligee.

The purpose of the surety bond is to ensure that the principal (usually a business owner) acts in accordance with regulations laid out by the obligee.

The obligee is usually the government, or a government agency, and makes bond requirements of various types, and to different values, depending on the industry in which, and the scale at which, the principal conducts their business.

The role of the surety, which is usually a surety company or bonding agency, is to provide surety bonds for the principal, and act as a guarantor that the principal will act in accordance with their obligations.

In exchange for payments by the principal, known as the surety bond premium, which are worth a small fraction of the surety bond amount, the surety company makes the full value of any bond they represent readily available in the event of a claim against the principal.

The value of a surety bond, or the bond amount, and the cost of that bond can both vary drastically due to a number of factors. The surety bond amount is set by the obligee.

For businesses operating at any given scale, within any given industry, in any given state, the obligee will determine how expensive a bond needs to be to act as an effective guarantee. Whilst some farmers in Nebraska are required to post bonds worth $5,000, some fidelity bonds can cost in excess of $1,000,000.

The price which any given principal pays for a surety bond, otherwise known as the bond cost, can vary too. The bond cost is usually determined by the personal credit history of the bond applicant.

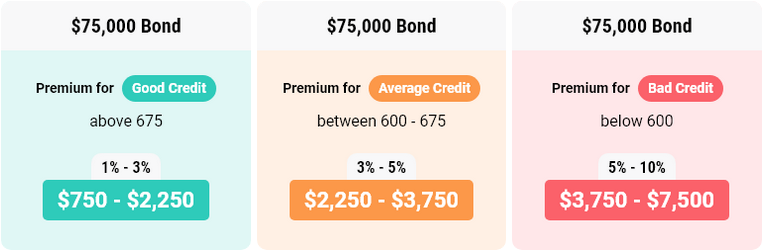

An applicant with an excellent credit history, which is associated with a good credit score above 675, can access surety bond premiums at rates between 1% and 3%. In this case, the cost of a $75,000 surety bond will fall between $750 and $2,250.

For applicants with an average credit history, with a credit score between 600 and 675, surety bond rates are usually available between 3% and 5%. These business owners might have to pay between $2,250 and $3,750 for a $75,000 surety bond. For more specific information, which is tailored to your business, you can apply now for a free quote.

How to get a $75,000 surety bond with bad credit.

Underwriters in the surety industry are often wary of applicants with bad credit history, as they are perceived to be higher risk. In this case, any score below 599 is considered to be a bad credit score and may hinder the application process.

However, applicants are rarely excluded from accessing surety bonds due to poor credit; they might just be charged a higher rate. For example, applicants seeking to purchase a $75,000 surety bond with bad credit are often offered annual premiums between $3,750 and $7,500. That translates to a surety bond rate of between 5% and 10%.

Lance Surety Bonds are specialists in helping their clients to access the best surety bond cost possible, even with bad credit. To access the best rates, you can begin your bonding process, or get your first bond quote now by filling in our online application form.

Most Common $75,000 Surety Bonds

Auto Dealer Bonds

The auto industry is heavily regulated to ensure the wellbeing of its customers. Subsequently, motor vehicle dealers are all placed under different bond requirements, based on where they are based and the scale at which they operate. Some states require medium size auto dealers to post surety bonds worth $75,000.

To find out if this applies to your dealership, you can learn more about different bond requirements by state.

Freight Broker Surety Bonds (BMC-84)

As handlers of large quantities of goods, and employers of large numbers of people, freight brokers are required by the FMCSA (Federal Motor Carrier Safety Administration) to post large freight broker bonds. Frequently, these bonds are to the value of $75,000 and sometimes more. These bonds, known as BMC-84 bonds, have a number of benefits over the BMC-85 trust fund agreements which requires the broker to deposit the full $75,000 in a bank account.

NVOCC Bond

NVOCCs, or and freight forwarders, are vulnerable to many of the same risks as freight brokers and are equally subject to bond requirements worth at least $75,000.

To find out more about the different types of surety bond, or for your free bond quote, contact Lance Surety Bonds today!

About Us