How much does a $5,000 surety bond cost?

A surety bond is an agreement between three parties: the principal (business owner), surety (bonding company or bonding agency) and obligee (regulating government body). The surety bond represents a financial guarantee that the principal will fulfill certain obligations.

For example, the surety bond can be used to ensure that consumers are compensated should an auto dealer, with whom they are conducting business, fail to perform according to the regulations set by the Department of Motor Vehicles, and the consumer decides to make a claim.

The value of surety bonds, or the bond amount, can vary dramatically depending on the industry in which they are being used.

For example, auto dealers specializing in small motorized vehicles, small scale contractors, and tax preparers often require surety bonds to the value of $5,000. However, the value of some surety bonds can exceed $1,000,000

The amount of a given surety bond and the bond rate are not the same thing. The cost of a $5,000 surety bond is dependent on several factors, including the industry for which the bond is being taken out, the type of bond, and the credit score of the business owner. These factors will be assessed during your online application

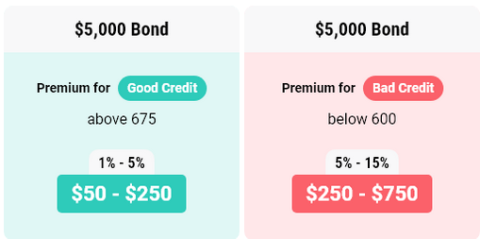

For applicants with good credit, surety bonds usually cost between 1% and 5% of their value. Therefore, for a surety bond of $5,000, an applicant with a strong credit history can expect to pay between $50 and $250.

How to get a $5,000 surety bond with bad credit

Within the surety industry, an applicant with a personal credit score lower than 650 is considered to have bad credit. They may have to pay a higher percentage of the surety bond amount, as underwriters at bonding companies therefore consider these applicants to be higher risk.

Surety companies provide indemnity for any claims made against a principal whose bond they hold, so it is in their interest to mitigate the risk of their own liability as much as possible. One way for them to do so is for the bonding company to increase their rates for applicants with bad credit.

If you want to begin a bond application, but have poor credit, the price of your surety bond premium may rise to a range between 5% and 15%. Therefore, a bond worth $5,000 might cost between $250 and $750.

Whilst the cost of bonds is often higher for applicants with bad credit, Lance Surety Bonds specializes in helping customers access the best-value bonds possible. This is true for all applicants, whether they have perfect or poor credit scores.

If you want to take out a $5,000 bond, but have bad credit, then the best first option is to apply for a free quote, or start your application to begin the bonding process.

Most Common $5,000 Surety Bonds

Contractor License Bonds

In certain states, contractors are obliged to post a surety bond to the value of $5,000 to obtain a license. These states include Alabama, Arizona, Indiana, Florida, Mississippi, and South Carolina.

Farm Labor Contractor Bonds

Certain states require farm labor contractors to hold bonds worth $5,000 or higher. There are different types of surety bonds needed for farmers in different states, so it is worth checking your local requirements.

Tax Preparer

In certain industries, bonds are used to protect clients against the case of malpractice by professionals with access to sensitive information. Tax preparers in California are regulated this way and require a $5,000 bond to obtain their license.

Notary Bonds

Notary publics in some states are required to post a $5,000 bond for notary commissions. Illinois notary bonds, for example, are required to public of Illinois against any financial loss due to improper conduct in the state.

Auto Dealer Bonds

Auto dealers are required to post surety bonds by most states. Whilst the value of auto dealer bonds is often much higher, many motor vehicle dealers who sell motorcycles and other similar vehicles are required to obtain a surety bond to the value of $5,000.

If you would like to post a bond, then your best next steps are to learn more about the bonding process, or register for a free bond quote.

About Us