How much does a $35,000 surety bond cost?

A surety bond is a legal and financial mechanism used to represent and guarantee the agreement of three parties. The first of these parties is the principal. The principal is usually a business owner and is obligated to post the surety bond by a regulating body.

This regulating body is the second party in the agreement, known as the obligee. The obligee is usually the government or a government agency operating under state law. The third party is known as the surety and is usually a company or agency founded specifically for the purpose of carrying out this role.

As such, they are known as surety companies, bonding companies, or bonding agencies. The role of the surety is to ensure that money to the value of a given surety bond is readily available.

The principal will pay the surety a fraction of the total bond amount, known as a surety bond premium, and in exchange the surety will provide indemnity to customers and clients of the principal.

Should a consumer make a valid claim against that principal in the case of a violation of the regulations determined by the obligee, the surety is the party which ensures that damages are readily available to compensate the consumer.

There are lots of different types of surety bonds, which vary based on the industry for which they are needed, the local government to which the principal is accountable, and the scale at which the principal operates.

Therefore, there is a lot of variety in the value of surety bonds, and subsequently an even wider variety in the cost of surrey bonds.

Surety bond prices will vary depending on several factors, the foremost these are the applicant's credit score relating to the business and, often, the personal credit of the applicant too.

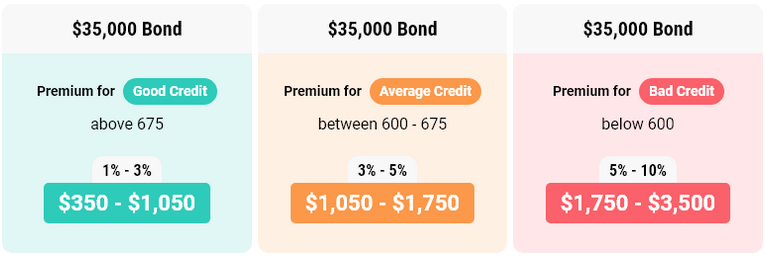

A business owner with average credit (which is understood as a credit score between 600-675) will often be charged a rate within the range of 3-5% of the total surety bond amount. This means that for a $35,000 surety bond, business owners with average personal credit can expect to pay a surety bond premium between $1,050 and $1,750.

For business owners with good credit (within the surety industry, this is accepted as a score above 675), then the surety bond premium may be between 1-3% of the overall surety bond value. In the case of a $35,000 surety bond, that means paying between $350 and $1,050.

How to get a $35,000 surety bond with bad credit

With most bond providers, underwriters consider any credit score below 599 to be “higher risk”. Past this threshold, applicants are considered to have “bad credit”. As the cost of surety bond premiums are usually determined by the applicant’s credit history, it is normal practice for a bonding company to charge applicants with poor credit history higher rates.

These higher rates are often between 5% and 10% of the total bond value, meaning that a $35,000 bond might cost an applicant with bad credit between $1,750 and $3,500.

Lance Surety Bonds are specialists in finding clients the best rates, regardless of their credit history. If you need to post a $35,000 bond for your business, but are worried about bad credit, then your best option is to begin the online bonding process now. Equally, you can apply for a free quote.

Most Common $35,000 Surety Bonds

Auto Dealer Bonds

The auto industry is very heavily regulated, and as such, requires bonds of all sorts of shapes and sizes. For example, in states such as Georgia, motor vehicle dealer bonds are set a $35,000 bond requirement in order to operate as operate a used car dealer business.

For more information on bonds, please check the requirements state-by-state using our free tool. You can also begin your online application process now to get access to the best surety bond rates.

About Us