How Much Does a $50,000 Surety Bond Cost?

The premium of a $50,000 surety bond can range from $500 to $5,000, fluctuating based on several conditions. Factors like the specific bond type, the applicant's credit score, business financials, industry expertise, and any claims on past bonds significantly influence the final cost.

It is important to note that there is a significant difference between the value of a surety bond, or the surety bond amount, and the premium paid for your surety bond, or the surety bond cost. In most cases, business owners are only required to pay a small fraction of the overall bond value.

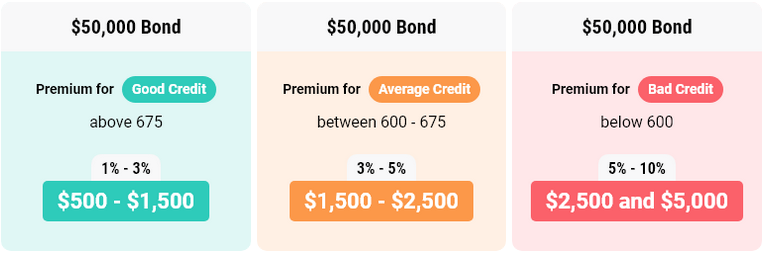

For applicants with a good credit score above 675, bond premiums are usually between 1% and 3% of the bond amount. For a surety bond worth $50,000, that means paying between $500 and $1,500. For more specific guidance, you can apply for a bond quote or use our surety bond calculator.

In the case of an applicant with average credit history, it is normal for surety underwriters to suggest a rate between 3% and 5% of the total bond value. Therefore, for many applicants, a $50,000 surety bond will cost between $1,500 and $2,500—usually paid as an annual premium.

How to Get a $50,000 Surety Bond with Bad Credit

Applicants with bad credit, which means a score of 599 or below, are considered to be “higher risk”. It is common practice for bonding companies to charge applicants with bad credit a higher bond rate as a way to mitigate this associated risk.

These rates often fall between 5% and 10%. Therefore, in the case of a $50,000 surety bond, applicants with bad credit might expect to pay between $2,500 and $5,000.

Whilst rates may be higher for applicants with a poor credit, in most cases it is still possible to access surety bonds, whatever your credit history. Lance Surety Bonds specializes in finding surety bonds at the best bond prices for all of their clients.

If you are concerned about your personal credit, then your best option is to begin the online application process now. Equally, for fast and more specific information, you can apply for a free quote.

Most common $50,000 surety bonds

Auto Dealer Bonds

The auto industry is subject to a wide variety of motor vehicle dealer bond requirements, which vary between states and depending on the size of the dealership. For motor vehicle dealers operating in states such as California, North Carolina and Virginia, the DMV or equivalent entity often requires a $50,000 auto dealer surety bond.

Contractor License Bonds

The value of contract license bonds varies wildly depending on the specialization and requesting entity. However, $50,000 contractor license bonds are common, and are required in states such as Illinois, Ohio and Utah.

Mortgage Broker Bonds

Surety bonds are especially important in industries where businesses have potential leverage over clients. To safeguard clients from principal malpractice, local governments in states such as Oregon, Maryland and Nevada require some mortgage brokers to post bonds worth $50,000.

About Us