How Much Does a Surety Bond Cost in 2024?

The cost of a surety bond typically ranges from 1% to 10% of the total bond amount. This percentage is determined based on a variety of factors, including the applicant's credit score, the type of bond needed, and the risk associated with the bond.

For instance, a $10,000 surety bond at a 1% rate would cost $100, while at a 10% rate, the cost would increase to $1,000.

Surety Bond Costs Explained

Your surety bond cost is a percentage of the total bond amount, also called the bond premium. There are two main factors for how that cost is determined by underwriters:

- The type of surety bond and the bond coverage required

- The credit history of the applicant

This percentage is also referred to as a 'surety bond premium' or a 'surety bond rate'.

It's important not to confuse your bond's cost with the total bond amount. The total bond amount is the full coverage (also known as penal sum) of the bond required by law, but it's not the amount you will have to pay.

Is the Bond Amount the Same as Your Bond Cost?

No, the cost of your surety bond is not the same as, or equal to what the bond amount is. As mentioned previously, it is only a small percentage of your total bond amount and is what is called the bond premium.

For example, if you have to provide a $20,000 Surety Bond for a Contractor License, if your rate is approved at 5%, then your surety bond cost would be only $1,000.

On the other hand, in case of a claim against your business, you might be liable for the full amount of your bond, which is why it is recommended to always keep your business in good legal standings.

Find out what your bond will be with our Surety Bond Cost Calculator below and keep reading to find out the factors that will affect it!

Surety bond cost calculator

What Determines the Cost of Your Surety Bond?

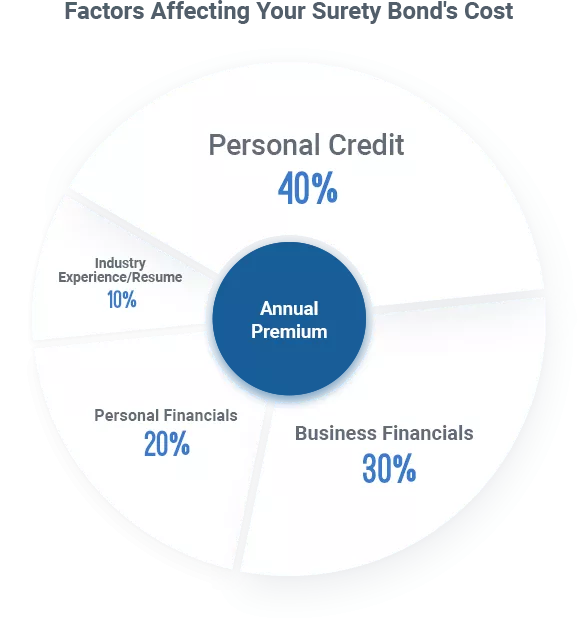

For most types of bonds, your surety bond rate is determined by several important individual and business factors.

Below, you will find a short list along with a breakdown of the most important bond quote factors, and an estimate of what impact they will have on your final surety bond rate.

Factors that Affect Your Surety Bond Rate

- Size of the Contract

- Type of Work Being Completed

- State Where Work is Being Conducted

- Personal Credit of the Business Owner

- Financial Strength of the Business (does not apply for Court Bonds)

For an even more detailed guide on the factors affecting the price of your surety bond, download our FREE eBook Guide!

Surety Bond Cost Table

Below is a table that shows the annual premium at rates ranging from 1-10% of the bond amount depending on the applicant's credit score. Line up the bond amount with a respective rate to see what the price of the surety bond will be.

Please note, this table does not take into account extended term lengths, required expirations dates, or any state-mandated taxes, etc. However, you can use the below figures as reference. As noted in the section above, bond rates can also be subject to factors other than your credit score.

Below is a table that shows annual premium at rates ranging from 1-10% of the bond amount depending on the applicant's credit score. Line up the bond amount with a respective rate to see what the price of the surety bond will be. Please note, this table does not take into account extended term lengths, required expirations dates, or any state-mandated taxes, etc. However, use the below figures as reference only. As already noted, bond prices can be subject to factors other than your credit score.

| Surety Bond Amount | Yearly Premium | ||

|---|---|---|---|

| Excellent Credit (675 and above) |

Average Credit (600-675) |

Bad Credit (599 and below) |

|

| $10,000 | $100 - $300 | $300 - $500 | $500 - $1,000 |

| $15,000 | $150 - $450 | $450 - $750 | $750 - $1,500 |

| $20,000 | $200 - $600 | $600 - $1,000 | $1,000 - $2,000 |

| $25,000 | $250 - $750 | $750 - $1,250 | $1,250 - $2,500 |

| $30,000 | $300 - $900 | $900 - $1,500 | $1,500 - $3,000 |

| $35,000 | $350 - $1,050 | $1,050 - $1,750 | $1,750 - $3,500 |

| $40,000 | $400 - $1,200 | $1,200 - $2,000 | $2,000 - $4,000 |

| $50,000 | $500 - $1,500 | $1,500 - $2,500 | $2,500 - $5,000 |

| $75,000 | $750 - $2,250 | $2,250 - $3,750 | $3,750 - $7,500 |

| $100,000 | $1,000 - $3,000 | $3,000 - $5,000 | $5,000 - $10,000 |

Commercial Bond Cost

Most types of commercial bonds (also known as license and permit bonds) are underwritten based solely on the owner’s personal credit score, especially when the bond's required amount is below $50,000. These types of bonds can include Contractor License Bonds, Auto Dealer Bonds, Mortgage Broker Bonds, and Tax Bonds as well.

Many types of license bonds may actually also qualify for an instant issue program, which offers approval without the need to do a credit check. These are usually offered for smaller bonds that are considered very low risk.

Construction Bond Cost

Contract bonds (also known as construction bonds) are usually required by the state, when a contractor is or will be awarded a given contract. These can include: Performance, Payment, Subdivision, or Bid Bonds.

Your personal credit will almost always be reviewed by a bond company when underwriting a performance bond request.

For smaller bond amounts, credit can be the most heavily weighted factor when determining whether an application will be approved and at what rate. However, larger contracts require business financial statements. In most cases, strong financials can help an applicant earn the best possible rate for their bond.

Court Bond Cost

Also known as probate bonds, these court bonds tend to be priced more aggressively than most other types of surety bonds, as rates typically range between just 0.5% to 1% of the bond amount. Percentages can be slightly higher for smaller bond amounts, or for extraordinary requirements.

As a rule, the larger the bond amount being required by the court, the lower the available premium rates.

Most of these require strong personal credit and will vary drastically based on the financial strength of the applicant.

Other Surety Bond FAQs

Put simply, a surety bond will pay out the amount of the bond is the case of a successful claim if a company fails to fulfil contractual obligations. This provides a level of indemnity to both the oblige and the customer. The company will need to reimburse the amount paid out at a later date.

Surety bonds are usually not paid on a monthly basis, and instead require a one-time payment according to the terms of the bond. This is most commonly yearly, however, some bonds are quoted on 2- or 3-year terms.

Generally speaking, credit score pulls for surety bonds will not affect your credit rating in the same way as a mortgage or a loan. This means that they are unlikely to exacerbate poor credit scores and will have a minimal impact. Having said this, large surety bond amounts and higher risk may impact credit scores more dramatically.

A $15,000 surety bond is most commonly associated with the California Contractor License and costs between $102 to $450 per year. You can get a free quote from Lance Surety based on a variety of factors including credit score and the number of years your business has been in operation.

$50,000 surety bonds are commonly used by auto dealers, contractors, mortgage brokers, DEMPOS, and telemarketing firms among others. The surety bond cost will depend on your credit score among other factors and will be set during the underwriting process.

Frequently Asked Questions

How much does a $5,000 bond cost?

- Excellent Credit: $50 to $150 per year.

- Average Credit: $150 to $250 per year.

- Bad Credit: $250 to $500 per year.

How much does a $10,000 bond cost?

- Excellent Credit: $100 to $300 per year.

- Average Credit: $300 to $500 per year.

- Bad Credit: $500 to $1,000 per year.

How much does a $20,000 bond cost?

- Excellent Credit: $200 to $600 per year.

- Average Credit: $600 to $1,000 per year.

- Bad Credit: $1,000 to $2,000 per year.

How much does a $25,000 bond cost?

- Excellent Credit: $250 to $750 per year.

- Average Credit: $750 to $1,250 per year.

- Bad Credit: $1,250 to $2,500 per year.

How much does a $30,000 bond cost?

- Excellent Credit: $300 to $900 per year.

- Average Credit: $900 to $1,500 per year.

- Bad Credit: $1,250 to $2,500 per year.

How much does a $35,000 bond cost?

- Excellent Credit: $350 to $1,050 per year.

- Average Credit: $1,050 to $1,750 per year.

- Bad Credit: $1,750 to $3,500 per year.

How much does a $40,000 bond cost?

- Excellent Credit: $400 to $1200 per year.

- Average Credit: $1,200 to $2,000 per year.

- Bad Credit: $2,000 to $4,500 per year.

How much does a $50,000 bond cost?

- Excellent Credit: $500 to $1500 per year.

- Average Credit: $1,500 to $2,500 per year.

- Bad Credit: $2,500 to $5,000 per year.

How much does a $75,000 bond cost?

- Excellent Credit: $750 to $2,250 per year.

- Average Credit: $2,250 to $3,750 per year.

- Bad Credit: $3,750 to $7,500 per year.

How much does a $100,000 bond cost?

- Excellent Credit: $1,000 to $3,000 per year.

- Average Credit: $3,000 to $5,000 per year.

- Bad Credit: $5,000 to $10,000 per year.

How much does a $1,000,000 bond cost?

- Excellent Credit: $10,000 to $30,000 per year.

- Average Credit: $30,000 to $50,000 per year.

- Bad Credit: $50,000 to $100,000 per year.

About Us