How much does a $30,000 surety bond cost?

A surety bond is an agreement made between three parties known as the principal, the obligee and the surety. In most cases the principal is a business owner operating in a regulated industry.

They are required by the obligee, which is often the government or a government agency, to post a surety bond as a financial guarantee of their adherence to the relevant industry regulations.

The surety is usually a specific surety company, bonding company, or bonding agency. It is their job to make money to the value of a given bond readily available. They do so in exchange for payments made by the principal, which are known as the surety bond premium.

The purpose of this money is to provide indemnity for consumers or clients should those consumers make a valid claim against a principal who has failed to act in accordance with the regulations of the industry in which they operate.

There are many different types of surety bonds specified for different businesses operating in different states, under different governments, at different scales and in different industries, and the value of these bonds can vary drastically.

In most cases, the bond rate, or cost of the bond, is only a small fraction of the overall bond amount. Therefore, whilst the exact bond rate will vary according to several factors, the cost of the bond will almost always be significantly lower than the amount of the bond.

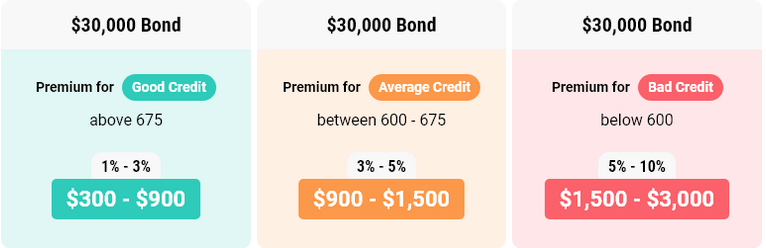

Among the main factors which influence the cost of any given bond is the applicant’s business and personal credit score. For example, an applicant with average credit can usually expect to pay a bond premium which lies somewhere between 3% and 5% of the total bond amount.

For example, an applicant with average credit can usually expect to pay a bond premium which lies somewhere between 3% and 5% of the total bond amount. For a bond to the value of $30,000, that means the principal can expect to pay between $900 and $1,500.

For applicants with good credit, rates can be even lower, and are often found between 1% and 3%. For a $30,000 bond, that means a business owner can expect to pay between $300 and $900 dollars.

For information more closely tailored to your needs, you can begin online today by registering for a bond quote or by using our bond cost calculator.

How to get a $30,000 surety bond with bad credit.

Applicants with a credit score below 600 are thought of as having bad credit and are subsequently considered “higher risk”. Applicants with a less-than-perfect personal credit can still access surety bonds in most cases. However, it is common for these bond applications to be subject to higher rates.

For an applicant with bad credit, a $30,000 surety bond can often cost somewhere between $1,500 and $3,000, or between 5% and 10% of the total bond price.

Whilst rates are usually higher for applicants with bad credit, it is still worthwhile searching for the best value bond rates relative to your credit report and history.

Lance Surety Bonds are specialists in helping their customers access the best bond rates, so if you are concerned about bad credit, it is worth contacting Lance Surety Bonds for a free quote, or begin the online bonding process now.

Most common $30,000 surety bonds

Motor Vehicle Dealer Bonds

The auto industry is very heavily regulated, and as such, there are many different types of surety bonds needed by different types of dealers in different states. Some medium-scale auto dealers in Vermont are required to post bonds to the value of $30,000 to be licensed. However, other auto dealer bonds exist depending on your business and location.

Farm Labor Contract Bonds

Given the variety of scales at which, and the variety of environments in which they operate, the bond requirements for farm labor contractors can vary quite significantly. However, farm labor contractors which are based in Oregon and employ more than 20 people are required to take out a surety bond amount to the value of $30,000.

Health Club Bonds

Surety bonds are often required of businesses who hold or have access to large sums of money, assets, or sensitive information on behalf of their clients as a means of safeguarding. In New Jersey, health clubs are subject to a $30,000 bond requirement as a safeguarding measure for members who pay their fees in advance.

To find exactly the type of bond you need, consult your local government agency, or have a look at the different bonds available by state. For the best rates available on $30,000 bonds, begin your online application process with Lance Surety Bonds today.

About Us