How much does a $25,000 surety bond cost?

A surety bond is a legal agreement which is made between three parties. These parties are known as the principal, the surety, and the obligee.

The principal is usually a business owner and is obligated to post a surety bond by the obligee. The obligee is usually the government or a government agency and uses surety bonds as a means of overseeing the regulation of various industries. The surety is usually a bonding company, otherwise known as a surety company or surety agency.

The principal that needs to post a surety bond pays a surety bond premium to the bonding company. When this premium has been paid, the bonding company provides indemnity against malpractice or fraud, so that should a valid claim be made against the principal in the event of a violation of regulations, the surety company can release the relevant damages immediately on behalf of the principal.

There are many different types of surety bond designed to accommodate principals in different industries operating at different scales across all 50 states.

For example, farming contractors in Nebraska require bonds to the value of $5,000 dollars. However, certain firms in Virginia are required to post bonds worth $1,000,000 or more.

In most cases, there is a significant difference between the total bond amount and the cost of the bond price. Generally, the cost of the bond, or the surety bond rate, is a small fraction of the overall surety bond amount usually quoted as an annual premium.

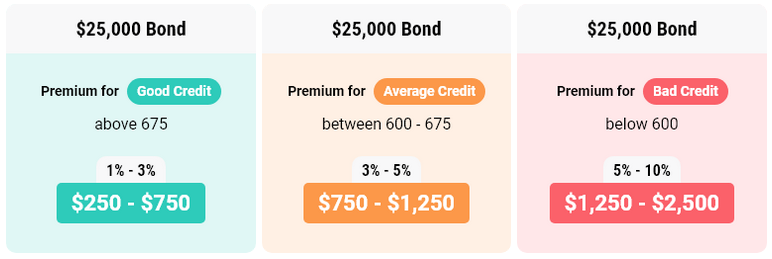

For example, though the rates for a $25,000 bond can fluctuate depending on the type of bond, the business credit history, the applicants personal credit score, and a few other factors, the price range for applicants with average credit is between $750 and $1,250, or 3-5%.

For applicants with a credit score above 675, rates are often available between 1% and 3%. That means that, for these applicants, a $25,000 surety bond can cost between $250 and $750.

How to get a $25,000 surety bond with bad credit

Credit scores below 599 points are labeled as higher risk by surety underwriters. Therefore, if you are a business owner with bad credit, it is usual to expect to pay higher rates, or a higher percentage of the overall bond price.

Bonding companies always seek to mitigate their risk, and charging “higher-risk” clients a higher rate is a common way in which they do this.

A normal bond rate for business owners with bad credit is between 5% and 10% of the total bond price. This means that applicants for a $25,000 bond who have a credit score below 599 can expect to pay between $1250 and $2500.

Whilst surety companies prefer applicants with a strong credit history, surety bonds are still accessible to those with poor credit and it is still worthwhile pursuing the best value rates relative to your credit score.

Lance Surety Bonds are specialists in the underwriting process, and work to find the best rates on surety bonds for their clients, no matter their credit history.

If you are looking to purchase a surety bond, and are concerned about bad credit, Lance Surety Bonds can begin helping you now. You can start either by starting the online bonding process here, or applying for a bond quote, or by checking our free bond cost calculator.

Most common $25,000 surety bonds

Auto Dealer Bonds

Motor vehicle dealers are required to take out a variety of bonds depending on the scale at which, and where they operate. $25,000 is a common bond price for auto dealers in Alabama, Florida and Massachusetts

Mortgage Broker Bonds

It’s important that governments provide mechanisms to safeguard their citizens when large quantities of money are being handled.

Mortgage brokers are one of several types of business which are heavily regulated to this end, and they are commonly required to post a mortgage broker bond of $25,000 bond in states such as California and Oregon.

Travel Agent Bonds

Travel agents and other sellers of travel based in Florida are often required to post bonds of $25,000. This is to ensure the funds collected through travel bookings are transferred to the appropriate individuals or entities properly.

Notary Bonds

$25,000 notary public bonds are required for some states, including Indiana where it must be in place for the duration of their 8-year commission. This bond protects the general public against financial loss due to improper conduct by notaries in the state.

The type of bond you need will vary depending on the industry in which you work, and state in which you operate. For the best rates on your $25,000 bond, begin your online application process now.

About Us