How much does a 1 Million Dollar Surety Bond Cost?

A surety bond is a mechanism which provides a financial guarantee that a principal, or business owner, will fulfil certain obligations. These obligations often mean complying with state laws or regulations set to ensure the safety of certain industries, including construction, auto-dealership, and finance, and can be used as a guarantee against malpractice, poor performance, or financial loss.

Generally speaking, the higher risk an industry is considered, the greater the value of the surety bond. For industries such as construction and finance, the amount of the bond can be worth in excess of $1,000,000.

There a many types of surety bonds, and the cost of a million-dollar surety bond will vary depending on a number of factors. These include the type of bond, the credit score of the business owner looking to post a bond, and the financial record of the business for which the bond is being bought.

To ensure the security of the surety company, greater scrutiny is given to businesses who wish to undertake a bond of this size, and the cost of the bond is determined much more carefully than it is with smaller bonds.

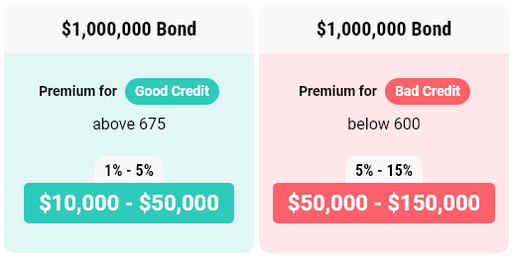

However, a $1,000,000 bond will, in most cases, cost less than $1,000,000. Whilst $1,000,000 is the value of the bond, or the bond amount - the cost, or the surety bond premium paid by the principal, is generally significantly lower.

For example, the cost of a Pennsylvania Money Transmitters Bond, which is to the value of $1,000,000, is usually between 1% and 5% of that value. In other words, for Money Transmitters in Pennsylvania, the cost of a $1,000,000 is likely to be between $10,000 and $50,000 dollars.

How to get a $1,000,000 surety bond with bad credit

Having a bad credit score may not prohibit you from accessing surety bonds, however, it does present some challenges during the underwriting process and will affect your bond rate.

Within the surety industry, an applicant with a credit score below 650 is considered to have bad credit, and as a result, is considered high-risk by surety companies.

As the surety is legally responsible in the case of a claim being made against the principle, it is in the interest of underwriters working for or with a given bonding company or bond agency to mitigate the risk of any bond which that company might support. One such way is to increase their rates for applicants whom they consider to be higher risk.

This is especially true for high-value bonds. In the case of high-value bonds, such as $1,000,000 bonds, evidence of business stability and a thorough credit check will likely be asked for, in conjunction with personal credit scores.

For those with poor credit undergoing bond applications, bond prices may rise to a range between 5% and 15%. In this case, the cost of a million-dollar bond might range between $50,000 and $150,000.

Fortunately, Lance Surety Bonds specializes in helping their customers to access bonds, regardless of their credit history. Working with our agents, we can help you to access the lowest possible rate, regardless of the credit score you currently have.

If you want to take out a $1,000,000 surety bond, but have bad credit, the best first step is to apply for a bond. Lance Surety Bond agents will search for the lowest possible premiums, and then supply you with the best contract possible for your credit rating. You can also begin by applying for a free quote.

Most Common $1,000,000 surety bonds

Money Transmitter Bonds

As businesses which handle large quantities of consumers’ money, Money Transmitters are required by some states to post million-dollar surety bonds as a guarantee for consumer safety. These states include Colorado, North Carolina, New York, Texas, and Virginia.

Construction Bonds & Performance Bonds

These are bonds which guarantee individuals and businesses perform as agreed in their contract, sometimes also known as contract bonds. In some states, such as North Carolina, general contractors must post a performance bond, or similar bond, in order to be granted a license to bid for construction projects.

In order to gain an intermediate or unlimited practitioner’s license, contractors are obligated to post a contractor license bond of either $1,000,000 or $2,000,000.

Fidelity Bonds

Fidelity bonds offer protection to businesses against potentially harmful actions committed by their employees.

Whilst they are not technically surety bonds, as businesses are not required to take them out by an obligee, they are often provided by surety agencies. Depending on the assets which employees have access to, the value of fidelity bonds can extend up to 1 million dollars.

Court Bonds

Court Bonds come in several forms. Fiduciary bonds may be used to protect the assets of somebody who is incapable of protecting those assets themselves.

Appeal bonds are used to guarantee adherence to the court ruling by the appellant. In the case of both types, the value of the posted bonds can reach $1,000,000.

If you would like to post a bond, then your best next steps are to learn more about the bonding process, or register for a free bond quote.

About Us