Surety Bond Claims

Many businesses get bonded without understanding the exact terms of the the bond agreement. In the worst case, this can result in a surety bond claim. That’s why it’s important to understand how surety bonds work, and what surety bond claims are.

What is a Bond Claim?

A surety bond claim is a legal action that a bond obligee can take against a bond principal, if the latter violates the law, or the conditions of the bond itself.

To understand how claims work, be sure to read up on what a surety bond is and how it works. Unlike insurance, surety bonds protect the clients and customers of the business obtaining the bond, rather than the business itself. A surety bond is an agreement between the business (bond principal), the customer or the public (bond obligee) and the surety issuing and backing the bond.

If an obligee feels they have been defrauded by a business, a claim against the business’s bond is their means of requesting compensation. If the claim is legitimate and successful, the obligee can then receive compensation up to the full penal sum of the bond.

Compensation for a bond claim is extended by the surety which has issued the bond. After the surety has compensated a claimant, the business must indemnify the surety for its coverage. Keep reading to out more about the different types of bond claims, and how you can avoid them.

Types of Surety Bond Claims

Surety bond claims differ, depending on the type of bond that a claim is made against. Though every claim is different, there are two major types of claims: license bond claims and construction bond claims.

License and Permit Bond Claims

License and permit bond claims are made against license bonds – the type of bonds that businesses and individuals must obtain when getting licensed in their state. These bonds are typically required by each state and sometimes also on a federal level. They guarantee that businesses comply with local and federal business regulations.

Whenever a business is found to be in violation of these regulations, a claim can be made against it. For example, take the case of a licensed and bonded auto dealer. If the auto dealer tampers with the cars he sells, sells a stolen vehicle, does not report or provide valid titles, intentionally provides false information to buyers, or misleads them in any other way, a claim can be made against his or her bond by the client.

Construction Bond Claims

A bond claim can similarly be made against construction bonds, which are sometimes also called contract bonds. Construction bonds are the bonds that contractors need whenever they are contracted to work on a particular project. These bonds guarantee that contractors will complete their work as it is specified within the project contract, as well as in accordance with state contractor regulations.

Not complying with these regulations– or violating the contract terms– can lead to a claim by the project owner. In this case, a claim is made against the performance bond. A claim can also be made against a payment bond. This is usually done by subcontractors, suppliers and laborers if the contractor has not paid them what is due in a timely manner.

How to Prevent Surety Bond Claims

Preventing or avoiding a bond claim is the smartest choice. Claims are expensive, time-consuming, and potentially reputation-ruining situations. The best and safest way for all businesses to avoid claims against their bond is simply to be diligent in performing their work, and never taking any dubious business shortcuts or making ‘gray-area’ decisions.

In particular, licensed businesses should always strive to adhere to the best practices in their industry, and be honest and fair with their clients. Staying up-to-date with industry regulations, and following up on changes introduced by legislation is very important as well.

To avoid construction bond claims, contractors should be exacting and stringent when it comes to contract conditions. Paying attention to all details concerning quality, deadlines and expected results, and clarifying everything with the project owner prior to signing a contract, can help avoid disagreements later on.

To avoid a claim, contractors should also plan their projects carefully, and avoiding taking on too much work, too fast. Regularly communicating– both with the project owner and one’s surety– about the status of the project and possible difficulties is another way to defuse a situation which can potentially lead to a claim. That way, steps can be taken early on.

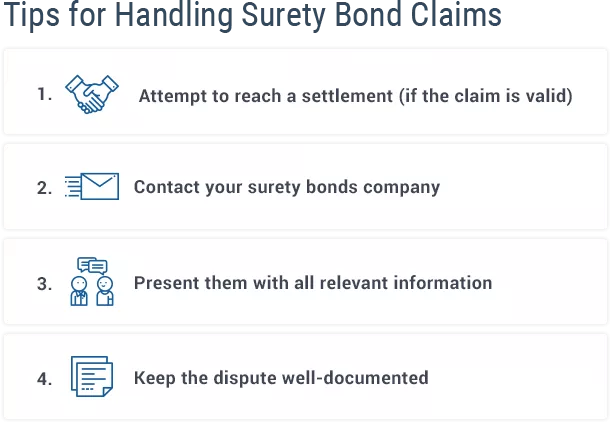

Despite your best efforts, you may still end up having a claim filed against your bond, as not everything is within your control.

In the case of a claim, the most important thing to remember is that your surety is your partner, and you can rely on them to assist you in sorting things out. Communicate with them clearly and openly and let them help you.

The second most important thing to remember is that you should always carefully keep all information, documentation, and correspondence related to the claim. This information can help your surety when seeking to resolve the situation. It can also be useful if the case should end up court and you need to defend your position.

Keep in mind that a settlement is also an option, especially if you are faced with a court case which could hurt you more than the settlement itself. Most importantly, it is always best to avoid a claim. Trying out all other possible options before going to court is a must, as bond claims can have a very negative effect on your business, your finances and your reputation.

About Us