How Much Does a $10,000 Surety Bond Cost?

The cost of a $10,000 dollar bond will vary depending on a number of factors, and will often cost between $100 and $1,000. The exact number varies between the different types of surety bonds, and the credit score, company financials, industry experience and claims on previous bonds of the business owner applying for the bond.

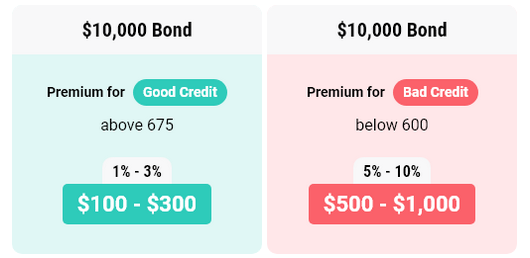

For applicants with good credit, the surety bond premium is often between 1% and 3% of the total value of the surety bond. This means that for a surety bond of $10,000, it is normal for an applicant with strong credit history to pay the surety company between $100 and $300.

How to Get a $10,000 Surety Bond with Bad Credit

Underwriters in the surety industry consider any credit score below 599 as “higher-risk”. For business owners who fall into this category of bad credit, it is normal to pay a higher percentage of the overall bond value.

This is normal practice amongst bonding companies, as they always seek to mitigate their own risk, and raising the bond price for“higher-risk” applicants is one such way for them to do so.

For applicants with bad credit, it is normal for surety companies to charge within the range of 5% and 10%. At these rates, the surety bond premium on a bond worth $10,000 will cost between $500 and $1,000.

In most cases, however, it is still possible to access surety bonds without a perfect credit history. Whilst the rates may be higher, Lance Surety Bonds are specialists who take pride in helping their customers access surety bonds for the best price available. If you are concerned about your personal credit, and want help accessing a surety bond, then you can apply for a free quote.

Most Common $10,000 Surety Bonds

Auto Dealer Bonds

Different motor vehicle dealers require different bonds, depending on where, and the scale at which they operate. California, for example, requires that wholesale dealers of motorcycles and ATVs post bonds worth $10,000. If you are looking to bond an auto dealer, you can check here to see the surety bond requirements for your state.

Contractor License Bonds

Contractor Licenses cover work at a wide variety of scales. Subsequently there is often variety in the required surety bond amount. However, some areas in Illinois, Nevada and Oregon specifically require $10,000 bonds.

For more detailed information on how much your $10,000 bond will cost, your best option is to begin your online application now and ask for a free bond quote.

About Us