Your Guide to Getting a Mortgage Broker License in California

401(K) 2013 / Foter / CC BY-SA

Forecasts are showing that the California housing market is poised for a pick-up, as affordability remains stable and rich investors are giving regular Joes some room in the market. If you’re considering applying for a mortgage broker license in California or expanding your existing practice to that state, now is a great time to jump on it.

Here’s an overview of the necessary steps you’ll have to take on your way to becoming a licensed broker.

Choosing a Mortgage Broker Type: DBO or BRE?

The State of California distinguishes between two types of mortgage brokers that each go through a different process of licensing and work in accordance with different laws.

The first type registers with the California Department of Business Oversight (DBO) and falls under the regulations of the California Finance Lenders Law (CFL). This means that DBO-licensed brokers can only work with loans issued by lenders who are also licensed by the same law.

The second type of mortgage broker license is issued by the California Bureau of Real Estate (BRE). Unlike DBO brokers, BRE brokers may work with all kinds of financial institutions.

Depending on the way you get your license, your practice will be governed by different laws. Make sure you choose the one that’s right for your business goals. Regardless of type, all California mortgage broker licenses are kept under the National Mortage Licensing System (NMLS).

NMLS Pre-Licensing Requirements

As in all US states, the NMLS has some pre-licensing requirements for all mortgage brokers. These include:

-

3 hours Federal Law classes;

-

3 hours Ethics classes;

-

2 hours non-traditional mortgage lending classes;

-

12 hours elective classes;

-

8 hours of continuing education with a NMLS-approved instructor each year;

The rest of the requirements vary dependending on the type of license you wish to obtain.

woodleywonderworks / Foter / CC BY

BRE Licensing Requirements

Mortgage brokers wishing to get licensed with the California Department of Real Estate must have at least two years of experience as salespeople, go through a mandatory background check, complete 8 college-level courses in the areas of financing and real estate, and successfully pass a written examination.

The cost of a BRE license is $330 plus additional fees for processing, credit report check and background check. All fees are non-refundable.

DBO Licensing Requirements

Licensing under the California Department of Corporation is somewhat similar, but doesn’t require prior experience as a salesperson or college-level courses.

While the application fee is smaller (at only $169), there is a bigger expense associated with a $25,000 surety bond requirement. Read on to find out more.

Mortgage Broker Bonds in California

The surety bond you are required to post with a DBO type license is called a mortgage broker bond. The bond is there to ensure that your business will operate in accordance with state laws and regulations. It also protects your customers, i.e the borrowers, from fraudulent practices. In case you are found guilty of breaking the surety bond agreement, a claim may be triggered against you.

In such cases, you become legally responsible to financially compensate the state or the client. It’s best, however, to avoid claims as that will damage your reputation and make it harder (and more expensive) for you to renew your mortgage broker bond.

Obtaining a California Mortgage Broker Bond

So how do you obtain a mortgage broker bond? As with all surety bonds, mortgage broker bonds are underwritten by companies known as sureties. By giving you the bond they are financially guaranteeing for you. That’s why in case of a claim they’re financially responsible for the compensation, too.

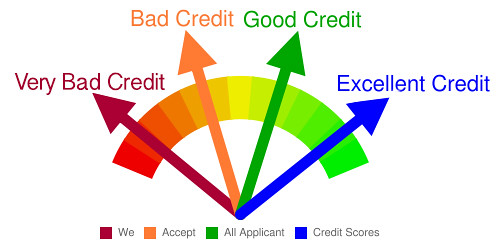

The total amount of the mortgage broker bond in California is $25,000. But you don’t need to have that much cash in order to get licensed. You get mortgage broker bonds by paying annual premiums, which are calculated after an evaluation of your credit history.

If you have outstanding credit, you will most likely pay premiums of about 1% – 3% of the total bond amount. If you have some credit issues, the price can go as high as 10%. That makes sense, as sureties always assume a 0% loss ratio.

Even if you have more serious credit issues, there is little reason to worry. 99% of applicants manage to obtain a mortgage broker bond. Of course, there are certain exceptions, such as applicants with open bankruptcies (closed ones are fine) or late child support payments.

Lance Surety Bonds is an agency that has partnerships with a large network of underwriters. This makes it possible for us to secure the best possible quote for your bond. Apply now and don’t hesitate to contact us should any questions arise!

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

Recommended Articles

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.