What is a Surety Bond?

Surety Bond Definition:

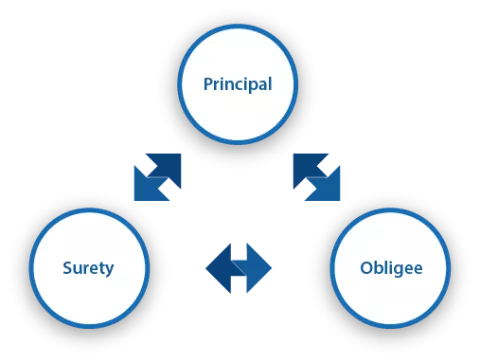

A surety bond is simply an agreement between three parties: Principal, Surety and Obligee. The surety provides a financial guarantee to the obligee (i.e. government) that the principal (business owner) will fulfill their obligations. Therefore, a surety bond is a risk transfer mechanism.

A principal’s “obligations” could mean complying with state laws and regulations pertaining to a specific business license, or meetings the terms of a construction contract, depending on the type of the surety bond.

If the principal fails to meet their agreed upon obligations with the obligee, the surety may be required to resolve the dispute by paying a claim to the obligee. It is in this sense that a surety bond is similar to a form of credit extended to the principal by the surety.

Three parties involved in a surety guarantee:

Three parties involved in a surety guarantee:

- PRINCIPAL: Person required to post bond.

- OBLIGEE: Government entity or person requiring principal to be bonded.

- SURETY: Provides financial guarantee to obligee on behalf of principal.

To find out your bond cost, fill out our short application below!

What does a surety bond guarantee?

For license & permit bonds, they guarantee that a principal understands and follows the regulations outlined for their specific license. This is where the term “license & bonded” comes from. Examples of a license violation could include fraud, misrepresentation, or late payment. If a covered violations causes a claim against the bond that the principal is unable to resolve, the surety will be required to pay the claim to the obligee.

In the construction industry, surety bonds typically ensure that a bonded contractor will fulfill their obligations specified in a signed contract. If a bonded contractor defaults on the contract, the surety guarantees that the obligee will be made whole. This can include either a financial payout or taking other actions to make sure the work is completed per the terms of the contract.

What happens if a claim is paid by the surety?

As a bonded principal, you must take every action possible to avoid claims. Claim activity may happen in the process of conducting business, whether valid or invalid, but it is ultimately the responsibility of the principal to make sure the disputes are resolved prior to the surety paying out on a claim.

Before becoming bonded, you will be required to sign a indemnity agreement with the surety company where you must agree to pay the surety back if they have to pay a claim due a violation by your company. The surety is only extending you credit, and therefore will expect to be reimbursed if a valid claim is paid. Having a paid surety claim may make it very difficult for you to become bonded again in the future, as it is a standard question on all bond applications, and is usually a cause for declination.

Is a surety bond insurance for my business?

To understand what a surety bond is, it’s helpful to know what it is not. A false misconception is that a surety bond is insurance for your business. This is not true. Instead, bonds are more like insurance for the public , or your customers, that you are required to pay for. Consider surety bonds a cost of doing business with the U.S. government.

Most businesses are also required to have some sort of separate business general liability coverage that protects their business from routine perils and losses. It’s important to understand that difference between the two to make sure you have the right type of coverage for your business.

NEW: Download our FREE ebook guide to learn all about the cost of surety bonds, regardless of which type of bond you're applying for!

Surety bond examples

Auto Dealer Bonds

A popular example from the license bonds category is that of auto dealer bonds. These bonds are required in virutally every state before a dealership can get licensed and be allowed to legally operate in the state. Below you can take a look at the bond forms for dealer bonds in California and Texas to get a better idea of what the typical surety bond language looks like:

Freight Broker Bonds

Freight broker bonds are another commonly required type of surety bond. They are a federal requirement, so every freight broker and forwarder must post one before they can get their license, regardless of which state they are in. Freight broker bonds are filed electronically, but we have included the bond form to use as reference:

Contractor License Bonds

Contractor license bonds are required in almost every state and many counties and municipalities have additional requirements of their own. Typically, they ensure compliance with relevant business codes and other regulations. They also provide protection to people who hire contractors for a job. Here are some sample bond forms:

These are just a few examples of commonly required license bonds. You can see a comprehensive list on our license and permit bonds page. For any questions, do not hesitate to contact Lance Surety Bonds at 877-514-5146!

Additional Resources

About Us