How to get bonded

For entrepreneurs, starting a business can be a very exciting and rewarding experience. Before being able to officially open your doors to the public there are multiple tasks that must be accomplished. Offering a product or service that will attract customers and generate profit is only part of the equation, as businesses also need to ensure compliance with government regulations pertaining to their line of business. So in addition to executing a strong business plan and finding a good location, business owners must also confirm if their company needs to be licensed, bonded and insured.

It is a business owner’s responsibility to determine what, if any, license requirements must be met at either the local, state or federal government level. Operating without a license can lead to heavy fines and prevent a small business from ever reaching its full potential. If required as part their license, the owner must also learn how to get bonded and insured as this will not only help to meet a regulatory requirement, but advertising that your company is both "Bonded and Insured" sends a message to potential clients that it is safe to do business with your company!

While most people have a basic understanding of insurance and how it works, the process of getting bonded may seem like foreign territory. It is our hope that by reading this page, we’ll provide you with a better understanding of how to get licensed and bonded.

Find out what your bond will cost by filling out the short application below.

“LICENSED AND BONDED”

The terms license and bonded usually go hand-in-hand. While there are a number of different types of surety bonds a business can obtain, such as contract, court and fidelity bonds, we are going to focus on the most common type which is generally referred to a license bond.

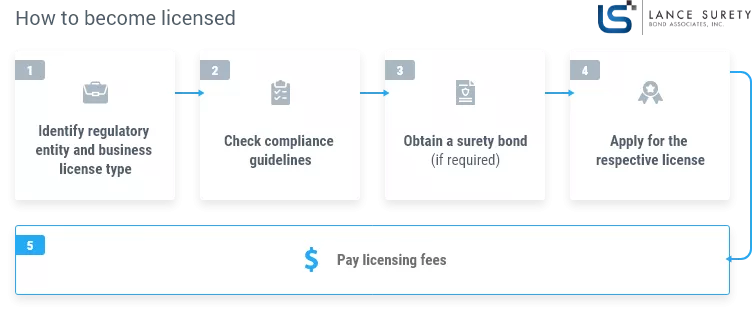

In the U.S., just about every type of business is regulated by some level of government, but most frequently at the state level. License regulations exist to oversee business operations, and act to protect consumers from fraudulent practices. One of the very first steps a prospective entrepreneur must take when formulating a business plan is determine who regulates their line of business, and whether or not their business must obtain a license. So, how do you get licensed and bonded?

Once you’ve identified what government entity regulates your business (obligee), you’ll want to consult with their compliance division to ensure you are aware of what is expected of your company. Today, most states have user-friendly websites that clearly outline how to apply for a respective business license, to include the business bonding requirements. Typically, you’ll be required to complete a license application, pay an application fee, and often are also required to post a surety bond prior to legally being able to operate.

License bonds are required to guarantee that a business is not only aware of but complies with all pertinent laws and regulations governing their specific license. Simply put, a surety bond is a requirement that must be met in order to become licensed. By posting a bond, the surety bond company that issues your bond is providing a guarantee to the obligee that your business is covered in the event of a legitimate claim up to penal sum of the bond. Continue reading to learn how to get a surety bond.

HOW TO BECOME BONDED

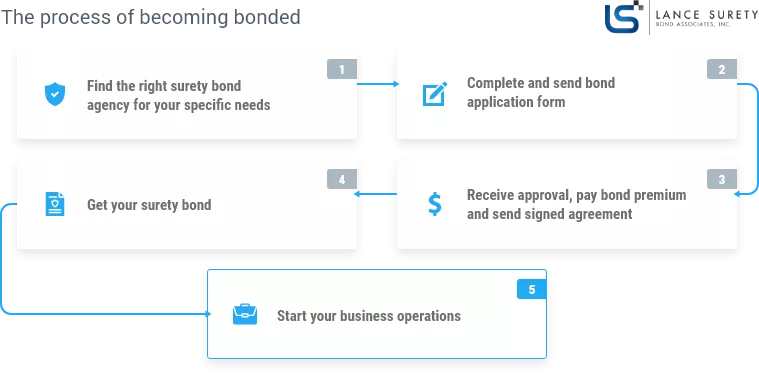

So you’ve identified that your business must be licensed, and that a surety bond is also required. How do you get bonded? The first step and potentially most important step is to find the right bond agency for your specific needs. While it is possible that local insurance agents might be able to assist in writing a bond for your business, the chances are that they will not be experienced with surety bonds, nor have access to the best available programs. This can cause delays and ultimately cost you more money. Surety bond agencies, such as Lance Surety Bonds, specialize in writing bonds and will be able to get you bonded faster and at lower rates. Additionally, if you’re trying to figure out how to get a surety bond with bad credit, you’ll want to make certain that the agency you apply with offers aggressive bad credit programs. While you may be tempted to lump your bond policy in with your insurance, beware of how this can affect your time and wallet.

Once you’ve identified where to get a surety bond, the next step is to simply apply for approval. While court and contractor bonds are often difficult to obtain without stellar personal credit and strong financial statements, becoming bonded for a license has a much higher success rate, as programs exist for applicants of all type. Approvals for license bonds can be offered in most circumstances based solely on the business owner’s personal credit. If you’re unable to get approved via your first application, don’t panic. It’s possible that you simply didn’t find a bond agency with access to the right type of bonding programs. Keep looking!

When you receive the approval you’re looking for, you’ll simply have to pay premium for your bond, and provide a signed copy of the indemnity agreement (or contract) between you and the bonding company. For options on how to purchase a bond, you’ll need to contact the respective agency. However, in the surety industry, it is standard that annual premium is paid upfront for a year worth of coverage. Upon receipt of payment and the signed agreement, your bond will be issued and sent out to you directly. The original copy of the bond will need to be signed by the business owner prior to being sent to the obligee as part of your license compliance. This is why bonds should not be sent directly from the surety to the obligee. As long as you do your best to stay ahead of any deadlines, it isn’t all that difficult to be bonded for a license. Read ahead for information on how to get bonded and insured.

THE COST OF GETTING BONDED

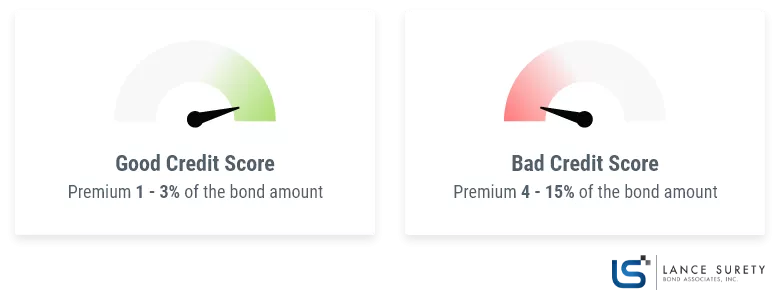

For any start-up business, it is crucial that a business owner properly projects start-up costs, which should include any surety bond costs. While some companies offer estimates of what a bond might cost, it’s probably in your best interest to go ahead and apply for a free quote sooner rather than later. When projecting costs, the last thing you want to do is underestimate what getting bonded will cost, as prices can vary substantially.

When you apply for a surety bond, you’re application will be reviewed by an underwriter. While an underwriter may choose to thoroughly analyze the financial statements and relevant experience of an applicant, the number one determining factor for license bonds is the business owner’s personal credit report. This is done because bond markets have identified a correlation between personal creditworthiness and claim activity against a bond. Since an underwriter’s job is to weigh the possible risk that a business owner might trigger a claim, it makes sense that higher perceived risk typically means higher bond premium.

If you have excellent credit and are considered a low risk to the surety, you’ll likely get approved at standard markets rate where annual premium typically ranges between 1 to 3% of the bond amount. Business owner’s with damaged credit naturally may be quoted at higher premiums, which can vary significantly depending on what high risk programs the agency you’ve applied with has access to. Bad credit programs for license bonds often range between 4 to 15%. For an in depth explanation on bond costs, read our section on “How much surety bonds cost.”

BONDED vs INSURED

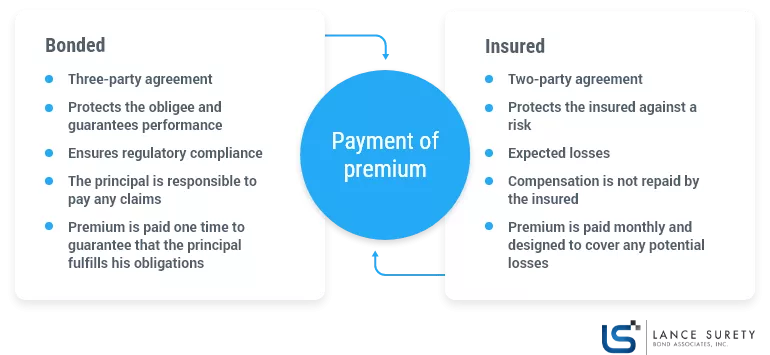

Depending on what type of business you are running, the government entity that regulates your specific license requirement (known as the obligee) will typically determine whether you must be both insured and bonded. While there are similarities, there are also some critical differences between how to get bonded and insured and they both operate.

Insurance is something a business owner pays for in exchange for coverage for their specific business. By definition, with insurance you pay a premium to the insurance company in order to transfer risk from you to the insurer. This is done with some level of expectation that a claim might be paid. If a claim is paid out, you rarely if ever have to reimburse the insurance company.

Instead of a two-party agreement, surety bonds include a third party. With bonding, a business owner pays premium to the surety bond company in exchange for surety credit. The surety makes the bond out to the government entity regulating your business for the benefit of the public. Bonds are not insurance for your business, but instead is similar to insurance for your customers that you have to pay for. If a claim is placed against your bond, it is your responsibility to get the issue resolved before a claim is paid out. In the unfortunate event that a surety pays a claim on your behalf, you will be required to reimburse them. Understanding the laws and regulations governing your business license, and taking action to prevent fraud or misrepresentation will go a long way towards avoiding such instances from occurring. For more information on the differences, visit our section on “Surety Bonds vs Insurance”.

About Us